Share:

Ethereum network's largest scaling solution's native token has yielded nearly 20% losses for holders over the past week. MATIC price nosedived below a critical support level on Friday, the asset needs to make a comeback above $1.04 or it could face a mass sell-off from 21,530 addresses.

Also read: Will Bitcoin begin its recovery rally ahead of US Nonfarm Payrolls data?

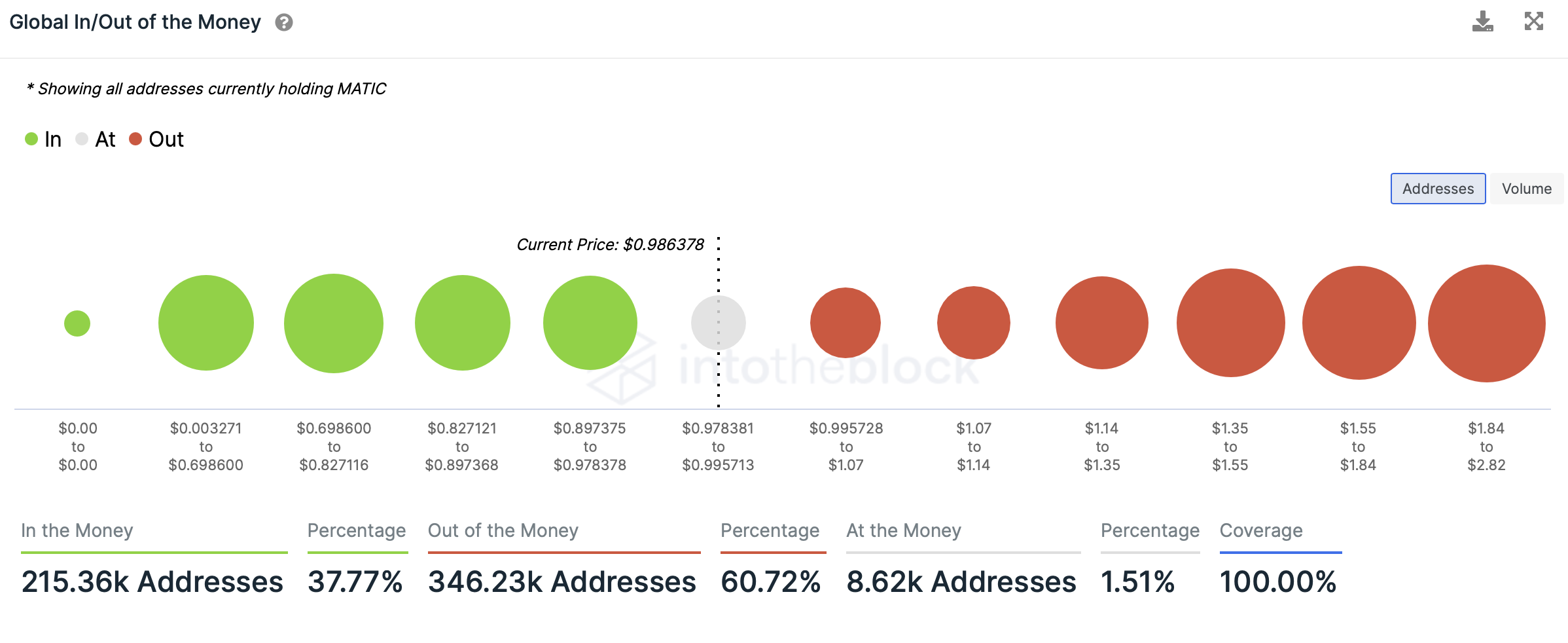

Based on data from crypto intelligence tracker IntoTheBlock, nearly 21,530 wallet addresses accumulated 4.21 billion MATIC tokens above the $1.04 level. This is therefore a critical support level for Polygon network's native token.

Giving in to the recent uncertainty and correction in the crypto market, MATIC price dropped nearly 20% over the past week. MATIC yielded 6.5% losses since Thursday and the token is trading close to its weekly low of $0.94, based on data from CoinGecko.

If MATIC fails to reclaim key support at $1.04, the altcoin could crumble under mounting selling pressure from 21,530 addresses shedding their token holdings.

Global In/Out of the money

The Ethereum scaling token is in need of an upswing to prevent the wallet addresses from panic selling a large portion of their 4.21 billion MATIC token holdings acquired between $0.99 and $1.07.

If the selling pressure on MATIC rises and the asset's price continues to decline, it could drop to next support at $0.89, a drawdown of nearly 15%. Nearly 50,000 wallet addresses scooped up 1.09 billion MATIC tokens between the $0.89 and $0.97 level, as seen in the chart above.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will no t be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.