By: Nadeem_Walayat

Ai Stocks Portfolio

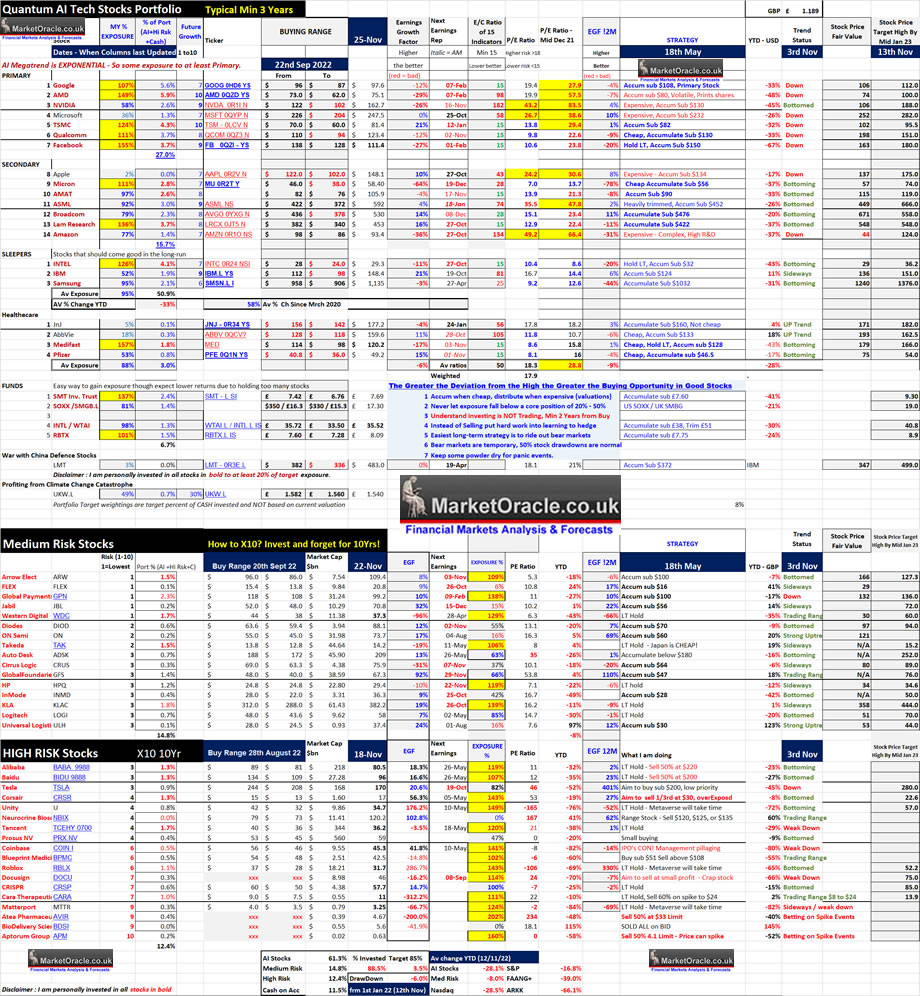

A quick look at the current state of my portfolio which is now 88.5% invested after arrival of approx 5% of fresh cash and after I sold all of my NBIX holding given that it earlier retreated from a multi year high, and that it tends to trade within a range of $125 to $76. I have update the table to indicate when columns were last updated. I have also replaced the beta column with something more useful called Future Growth (1-10), which is basically how I see the COMPANY doing in terms of future growth potential where 10 is the highest and 1 is the lowest, note this does not mean that the stock prices will match growth potential due to a myriad of factors such as sentiment, valuation and politics, but it gives insight into the underlying prospects for the businesses where the two stocks that score 10 are AMD and TSMC which is why I am heavily invested in both and don't fret about stock price drops in either as recently experienced because the underlying businesses have huge long-te rm future growth potential. Stocks that score 9 are Nvidia, Facebook, ASML and IBM, which again means I am not too phased by what we recently witnessed with the likes of META and and Nvidia, stock prices rarely reflect the actual state of the underlying business as they oscillate between extreme fear and extreme FOMO as illustrated when one watches the Cartoon Network (CNBC).

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/AI-stocks-portfolio-25th.jpg

Coinbase - COIN $45 - EGF -140%, -14%, P/E -8

Crypto bear market aside what's the big problem with Coinbase? The problem is the management are pillaging the coffers to reward themselves for doing a bad job as I have been warning of for the whole of this year! CONBASE!

A huge mistake investing in this Cathy Wood turd stock that produced fake financials which hid their true intentions in the run up to the IPO! I should have stuck to my rule of avoiding IPO's! CONBASE! Now like most stuck waiting for a minor miracle, crypto mania FOMO that is likely several years down the road to exit on. I supposed it could be worse we could have been hoodwinked into investing in FTX stock!

The fundamentals remain dire, CONBASE is reporting losses quarter on quarter all whilst the management reward themselves by printing more shares. It's gong to take FOMO mania to exit from this stock at even a small profit. Each time one thinks the stock has made a bottom off it goes lower, did this at $200, $156, and $100, current low is $45, will break that was well? This is the problem with BAD MANAGEMENT, they could not care less about the stock price because they just keep printing and selling more shares to reward themselves. Now we eye $45 as support and break above $100 for the slow climb back to over $200. It's going to take crypto FOMO to see this stock recover and even then it will probably be met with huge amounts of selling by insiders after all it's free money for them as they never PAID a penny for any of the stock they are selling. Hopefully clueless investors such as Cathy Crypto Wood can help FOMO the stock price on hype but I have no faith in the long-term prospe cts for CONBASE. My average buy is $192, I'll be seeking $200 to start reducing exposure which given the state of the crypto markets is a good couple of years down the road. Which given the fact that I am investing rather then trading is not much of a big deal as I do see myself eventually reducing exposure to Conbase by at least 50% AT A PROFIT! That's the thing about investing one can be WRONG and STILL get out with a profit. Time will tell!

The bottom line is that whilst it is bad it could be worse as we await the return of the crypto FOMO lemmings to lift all crypto boats higher.This article is an excerpt form my recent analysis on the current state of the embryonic stocks bull market Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION! that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is sooon set to rise to $5 per month.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Most recent analysis includes -

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this increases to $5 per month in the new year.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.